Denne uken ble hedgefondet Oaktree Capital kjent for norske investorer. Statens Pensjonsfond Utland har nemlig sammen med Oaktree og to andre amerikanske hedgefond, Och-Ziff og Farallon, kjøpt seg opp i misligholdt kinesisk gjeld.

Med på laget har de også fått med seg Temasek, Singapores statlige investeringsfond, samt China Cinda Asset Management. Det var opprinnelig Oaktree og China Cinda som gjorde avtale om samarbeid.

Oaktree Capital er notert på New York Stock Exchange og har en markedsverdi på $8.3 milliarder. Forvaltningsselskapet har 700 ansatte fordelt på 13 kontorer spredt over USA, Asia og Europa. Selskapet ble stiftet i 1995.

Styreformann Howard Marks er en av gründerne bak selskapet. Hans markedssyn som kommer til uttrykk i investorbrev og er kjent både for å være nyanserte og ha høy treffsikkerhet. Blant annet var han i 2007 klar på at vi stod foran en finansiell krise.

Her er noen utdrag fra investorbrevet han sendte ut tidligere denne uken:

«Today’s financial market conditions are easily summed up: There’s a global glut of liquidity, minimal interest in traditional investments, little apparent concern about risk, and skimpy prospective returns everywhere. Thus, as the price for accessing returns that are potentially adequate (but lower than those promised in the past), investors are readily accepting significant risk in the form of heightened leverage, untested derivatives and weak deal structures.

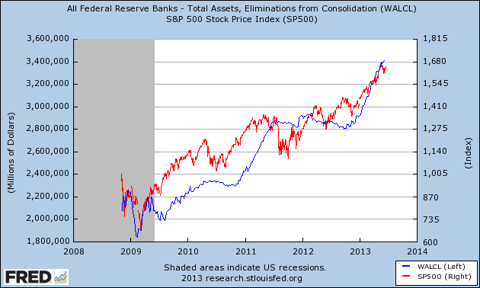

Now we’re seeing another upswing in risky behavior. It began surprisingly soon after the crisis (see Warning Flags, May 2010), spurred on by central bank policies that depressed the return on safe investments. It has gathered steam ever since, but not to anywhere near the same degree as in 2006-07.

When people start to posit that fundamentals don’t matter and momentum will carry the day, it’s an omen we must heed.

While the extent is nowhere as dramatic as in 2006-07 – and the psychology behind it isn’t close to being as bullish or risk-blind – I certainly sense a significant increase in the acceptance of risk. The bottom line is that when risk aversion declines and the pursuit of return gathers steam, issuers can do things in the capital markets that are impossible in more prudent times.

In short, it’s my belief that when investors take on added risks – whether because of increased optimism or because they’re coerced to do so (as now) – they often forget to apply the caution they should. That’s bad for them. But if we’re not cognizant of the implications, it can also be bad for the rest of us.

Certainly risk tolerance has been increasing of late; high returns on risky assets have encouraged more of the same; and the markets are becoming more heated. The bottom line varies from sector to sector, but I have no doubt that markets are riskier than at any other time since the depths of the crisis in late 2008 (for credit) or early 2009 (for equities), and they are becoming more so.»

Heldigvis avslutter Marks investorbrevet på en noe mer positiv måte:

«No, I don’t think it’s time to bail out of the markets. Prices and valuation parameters are higher than they were a few years ago, and riskier behavior is observed. But what matters is the degree, and I don’t think it has reached the danger zone yet.

Over the last 2-3 years, my motto for Oaktree has been consistent: “move forward, but with caution.»

Det er liten tvil om at vurderingene til Howard Marks står i grov kontrast til forventningene som fremsettes her hjemme.

Det er i denne anledning betryggende for verdien av norske pensjoner at Statens Pensjonsfond Utland foretrekker å være investert med aktører som har et noe mer nyansert syn på utviklingen. Oaktree Capitals forvaltningskapital på $77 milliarder tyder på at også andre investorer setter pris på dette.